What Factors Affect Cadastral Income?

Is cadastral income more or less?

One must pay a property tax every year. It is determined by the cadastral income.

Why do we have to pay property taxes? How a cadastral income is calculated, and what factors affect cadastral income? The region where you live determines your cadastral income.

There are other factors that can affect cadastral income. We explain what cadastral income is and what factors affect it.

The cadastral income in a nutshell

Are you the one who owns the property? Then you must pay the property tax every year. A regional tax based on cadastral income. The notional return on your property is equal to the cadastral income, which is the average net income you would earn if you rented out the property for a year. The amount you pay depends on the municipality where you live and in which region you are located.

Reporting of quay revenue is mandatory

The General Administration of Patrimony documentation requires you to submit a form if you have just built a home. Within thirty days of moving into the house, you must submit this form. Your cadastral income is calculated based on this form. There is a chance that an official will come and check the data on the spot, so it is best to fill in the data honestly.

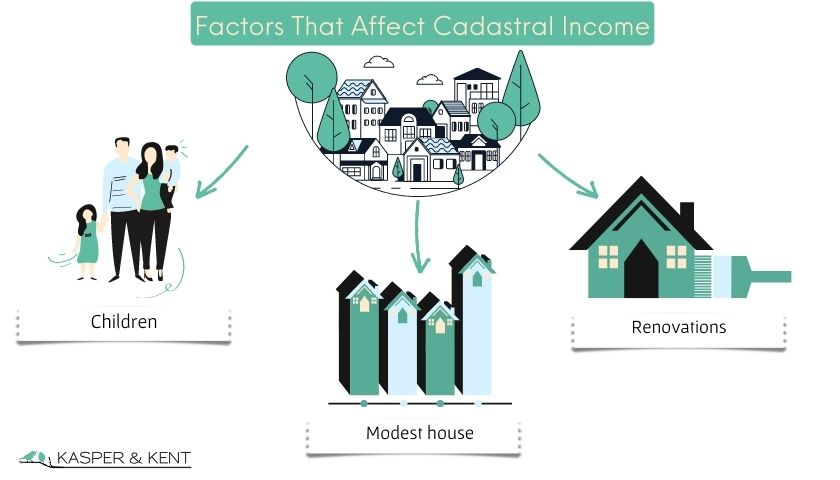

Influences on cadastral income

A reduction or increase in cadastral income can be caused by various factors. We list some of the factors that affect it.

CHILDREN

If you have dependent children, you can get a reduction on the property tax. However, this varies by region. To receive this reduction, you must have at least two children. In Wallonia, you must have at least 2 children, 1 of whom is a dependant.

MODEST HOUSE

A modest home is one whose cadastral income is less than €745. Only then is it possible to be granted a 25% reduction in property tax. In the Flemish Region, this refers to the properties you own in Flanders. The real estate you own throughout Belgium is a focus for the Walloon Region and the Brussels Capital Region.

RENOVATIONS

The likelihood of an increase in cadastral income is very high if the living comfort of the home improves. If the renovations cause the non-indexed cadastral income to rise above the €745 limit, you will no longer enjoy a 25% reduction for a modest home.

Cadastral income may be revised when the area in which you live improves.

INVESTMENTS THAT SAVE ENERGY

Certain energy-saving investments do not affect cadastral income. There is a difference between renovations that increase comfort and energy-saving measures.

In short, a renovation that improves the comfort of the home, such as a new roof, can increase cadastral income. Energy-saving measures, such as installing solar panels, do not affect cadastral income. However, you must pay the costs of installing the energy-saving measures.

Conclusion

In summary, cadastral income is the notional income you earn from the property. It is determined by the location of the property, the composition of your family, and the level of comfort (habitable area) of your home.